Contents

- 1 Introduction

- 2 Understanding Silver as an Investment

- 3 How Silver Prices Are Determined

- 4 Why Use Fintechzoom for Silver Price Tracking

- 5 Navigating Fintechzoom for Silver Prices

- 6 Silver Price Trends and Analysis

- 7 Investing in Silver: Tips and Strategies

- 8 The Role of Technology in Silver Price Tracking

- 9 How to Start Investing in Silver

- 10 Silver vs. Gold: Which is Better?

- 11 Conclusion

- 12 FAQs about Silver Price Fintechzoom

Introduction

In investments, keeping track of the latest trends and prices is crucial for making informed decisions. One valuable resource for tracking silver prices Fintechzoom. This article explores everything you need about silver prices and how Fintechzoom can be your go-to platform for staying updated.

Understanding Silver as an Investment

Historical Significance of Silver

Silver has been a valuable asset for centuries, serving as both currency and a store of value. Its historical significance continues to influence its role in modern investment portfolios.

Comparing Silver with Other Precious Metals

While gold often steals the spotlight, silver offers unique advantages. It is more affordable, has diverse industrial applications, and usually sees higher volatility, which can mean greater potential returns.

How Silver Prices Are Determined

Market Factors Affecting Silver Prices

Several factors influence silver prices, including economic data, inflation rates, and market speculation. Being aware of these variables will enable you to predict price changes.

The Role of Supply and Demand

The balance between supply and demand is a fundamental driver of silver prices. Changes in mining production and industrial demand can significantly impact the market.

Impact of Geopolitical Events

Geopolitical events, such as trade wars and political instability, can cause fluctuations in silver prices. Investors need to stay informed about global events that could affect the market.

Why Use Fintechzoom for Silver Price Tracking

Features of Fintechzoom

Fintechzoom offers real-time silver price tracking, historical data analysis, and customizable alerts, making it an invaluable tool for investors.

Benefits of Using Fintechzoom

With Fintechzoom, you get accurate and up-to-date information, helping you make informed investment decisions. The platform’s user-friendly interface and detailed charts simplify the process of tracking silver prices.

How to Find Silver Prices on Fintechzoom

Accessing silver prices on Fintechzoom is straightforward. Visit the website, navigate to the precious metals section, and select silver. You’ll find current prices, historical data, and market analysis.

Customizing Your Silver Price Alerts

Fintechzoom allows you to set up customized alerts for silver prices. This feature ensures you always take advantage of significant price changes, helping you stay ahead in your investment strategy.

Interpreting Silver Price Charts and Data

Fintechzoom provides detailed charts and data on silver prices. Learning to interpret these charts can help you identify trends and make informed predictions about future price movements.

Silver Price Trends and Analysis

Recent Trends in Silver Prices

Silver prices have seen notable fluctuations in recent years. Economic recovery, industrial demand, and investor sentiment contributed to these trends.

Predicting Future Silver Prices

While predicting exact prices is challenging, analyzing market trends and expert opinions can provide valuable insights. Many analysts use historical data and economic indicators to forecast future price movements.

Case Studies and Expert Opinions

Examining case studies and expert opinions can offer a deeper understanding of the silver market. Fintechzoom frequently features analysis and predictions from industry experts.

Investing in Silver: Tips and Strategies

Long-Term vs Short-Term Investment Strategies

Deciding between long-term and short-term investment strategies depends on your financial goals. Long-term investments in silver can hedge against inflation, while short-term trades can capitalize on market volatility.

Diversifying Your Investment Portfolio with Silver

Including silver in your investment portfolio can provide diversification, reduce risk, and enhance potential returns. Silver often performs well when other assets are underperforming.

Risks and Rewards of Investing in Silver

Like any investment, silver comes with risks and rewards. Understanding these can help you make balanced and informed decisions.

The Role of Technology in Silver Price Tracking

How Technology is Changing the Way We Track Silver Prices

Advancements in technology have revolutionized the way we track and analyze silver prices. Online platforms like Fintechzoom provide real-time data and sophisticated analysis tools.

The Rise of Fintech in the Precious Metals Market

Fintech has increased transparency and accessibility to the precious metals market. Investors can now access detailed information and make transactions more efficiently.

Future Technological Advancements in Silver Price Tracking

Technological advancements will further enhance our ability to track and analyze silver prices, providing more precise and actionable data.

How to Start Investing in Silver

Steps to Begin Investing in Silver

Starting your silver investment journey involves several key steps: research, choosing a reliable dealer, deciding on the form of silver (bullion, coins, ETFs), and making your purchase.

Where to Buy Silver

You can buy silver from various sources, including online dealers, local coin shops, and investment brokers. Each option has pros and cons, so choose the one that best suits your needs.

Understanding Silver ETFs and Mutual Funds

Investing in silver ETFs and mutual funds offers a way to gain exposure to silver prices without holding the physical metal. These investment vehicles can provide liquidity and diversification.

Silver vs. Gold: Which is Better?

Pros and Cons of Investing in Silver vs. Gold

Both silver and gold have their advantages. Silver is more affordable and versatile, while gold is seen as a more stable store of value. Your decision is based on your risk tolerance and investing objectives.

Historical Performance Comparison

Historically, gold has been less volatile than silver, but silver often offers higher returns during bull markets. Comparing their performance can help you decide which metal aligns with your strategy.

Future Outlook for Both Metals

The future outlook for silver and gold depends on various factors, including economic conditions and market demand. Making smarter investment decisions can be aided by remaining knowledgeable about these factors.

Conclusion

Silver remains a valuable and versatile investment option. With the help of platforms like Fintechzoom, you can stay updated on silver prices and make informed decisions. Whether you’re a seasoned investor or just starting, understanding the dynamics of the silver market is crucial.

FAQs about Silver Price Fintechzoom

Q: Is silver a good investment for beginners?

A: Silver is a good investment for beginners due to its affordability and potential for high returns.

Q: How often should I check silver prices?

A: It depends on your investment strategy. Long-term investors might check prices less frequently, while short-term traders should monitor them regularly.

Q: What are the best tools for tracking silver prices?

A: Fintechzoom, Bloomberg, and Reuters are excellent tools for tracking silver prices.

Q: Is it possible to use my retirement account to invest in silver?

A: Yes, many retirement accounts allow investments in precious metals, including silver.

Q: What effects does investing in silver have on taxes?

A: Tax implications vary by country and type of investment. It’s advisable to consult with a tax professional to understand your specific situation.

Latest Post!

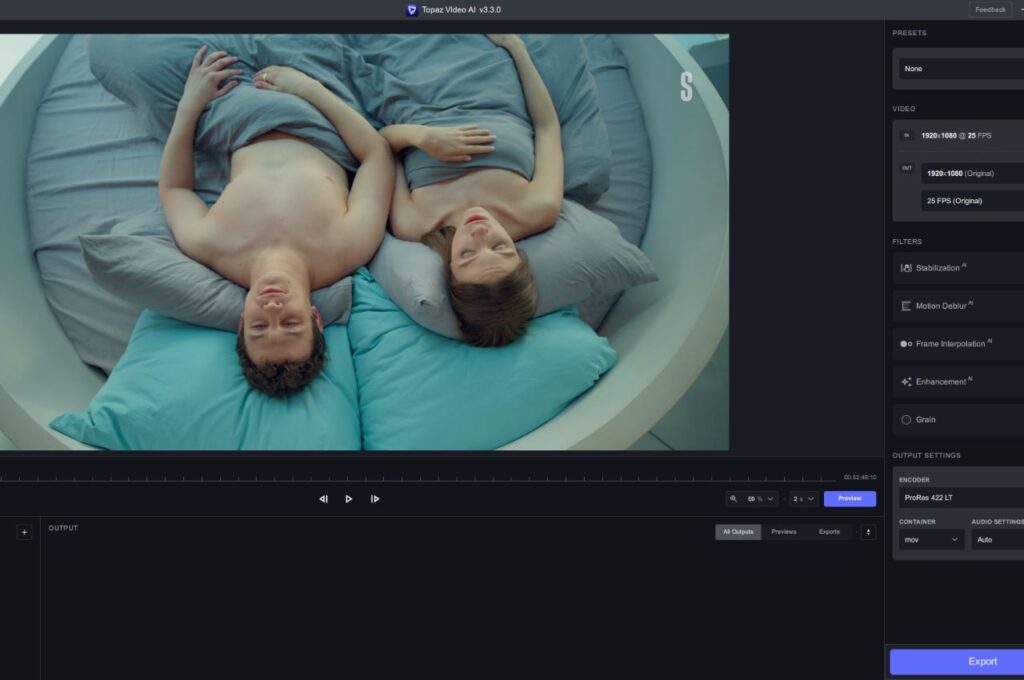

- AI-Enhanced Video Techniques: Elevate Your Content Creation

- The Benefits of Co-Ed Basketball Training: Building Skills and Teamwork

- Why Monitoring Your Testosterone Levels is Crucial for Men’s Health

- What You Should Know About Receipt Paper: A Complete Guide

- Unpacking the Style Statement: The Allure of Gina Moore Purple Bomber Jacket

- A Comprehensive Guide to Torrent Sites in 2023